🎁 Exclusive Discount Just for You!

Today only: Get 30% OFF this course. Use code MYDEAL30 at checkout. Don’t miss out!

The videos will help you understand how we use #ClusterDelta tools and all also the parameter settings of each chart, including PROFESSIONAL COURSE videos.

File Size: 11 GB.

Gova Trading Academy – PRO COURSE Order Flow Strategy

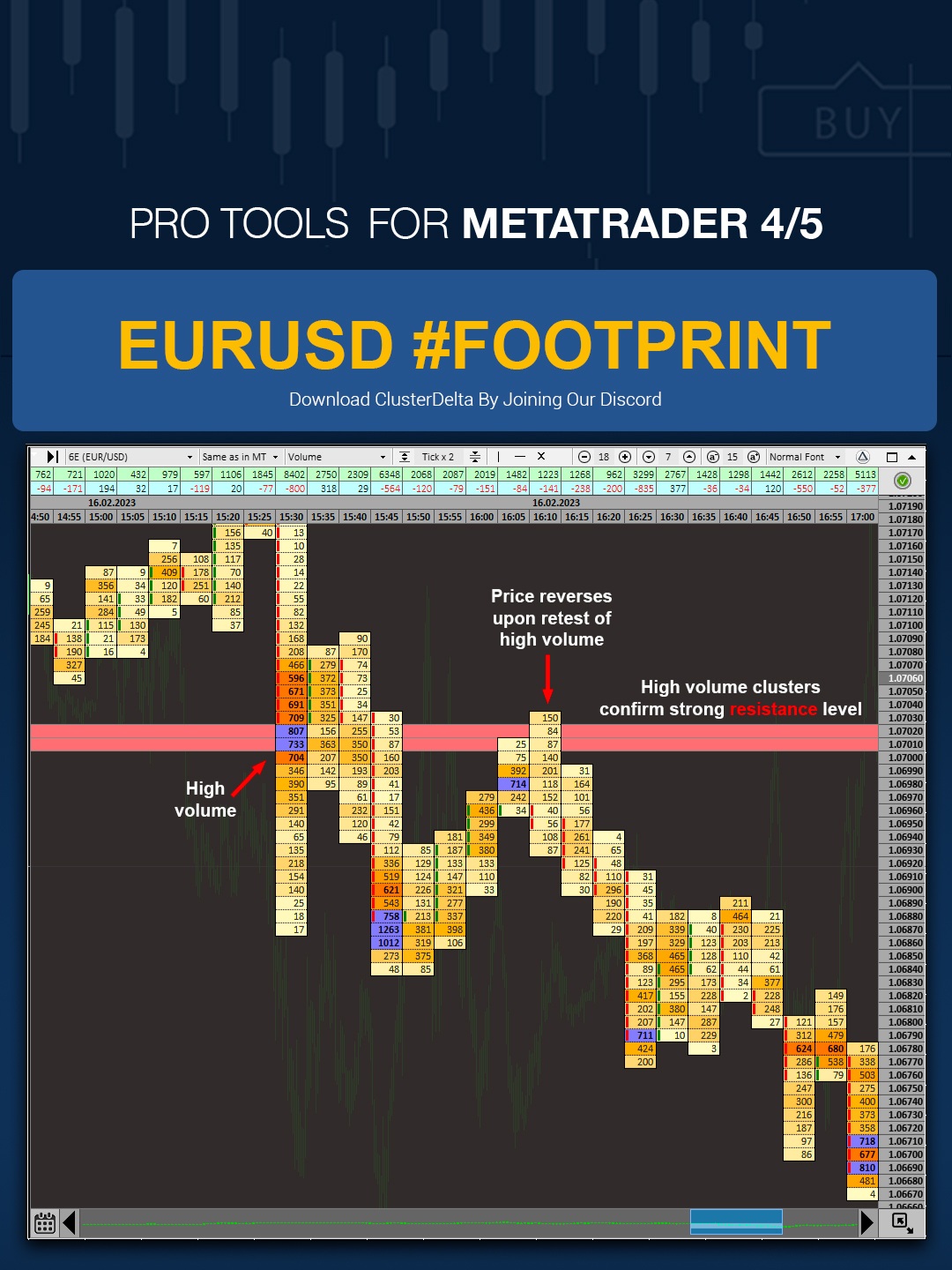

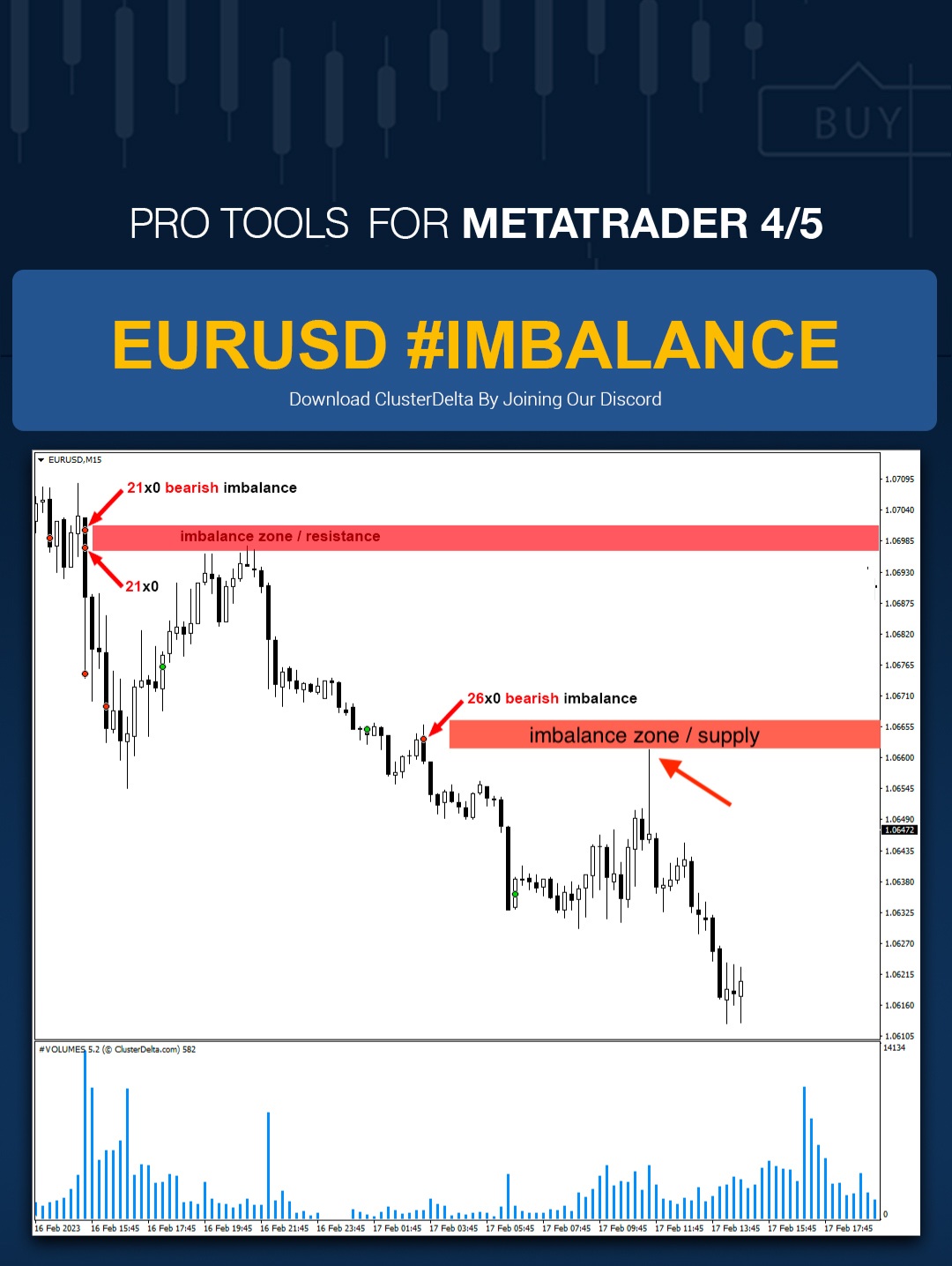

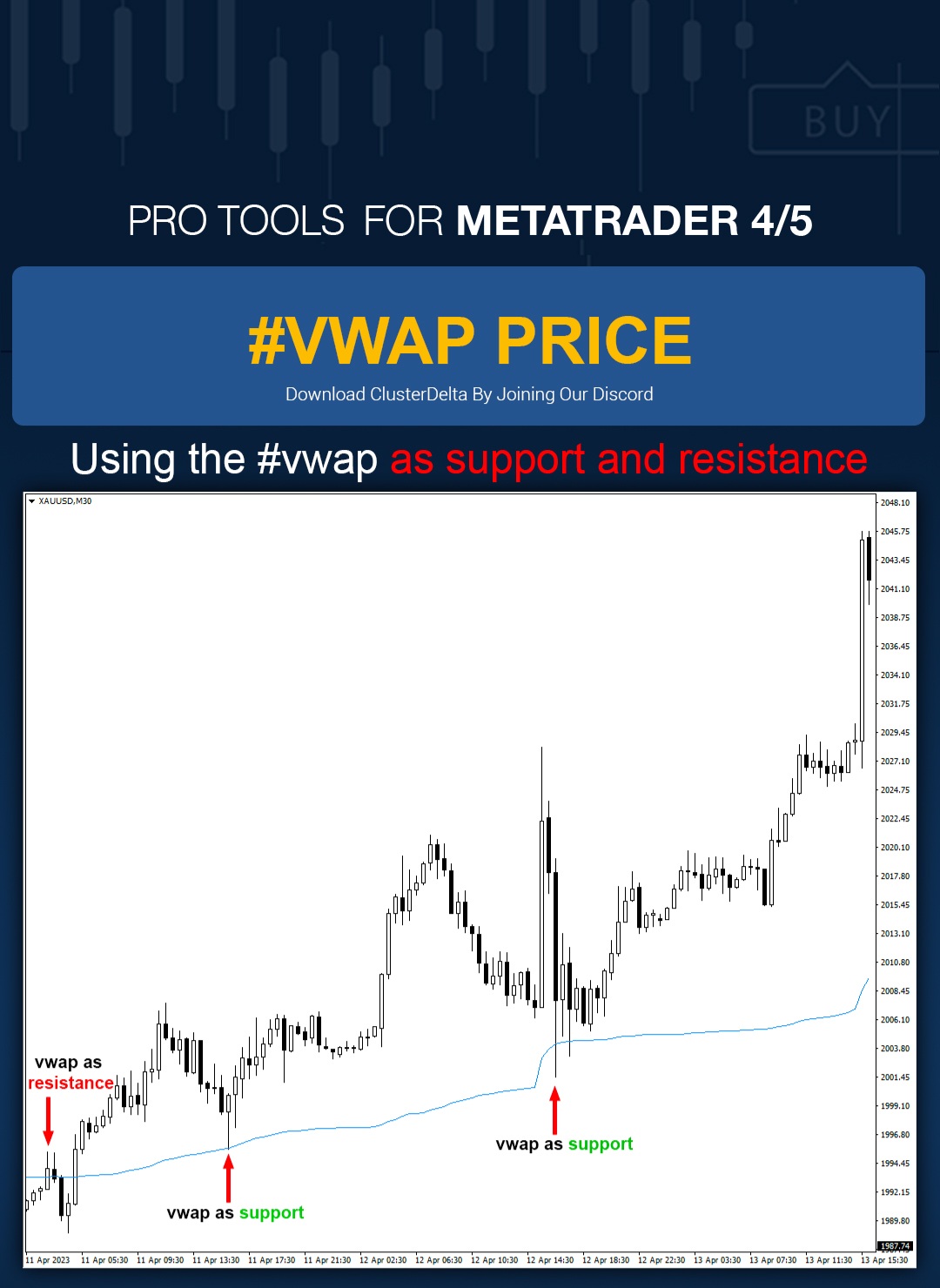

SEE WHAT IS NOT SEEN using ClusterDelta Professional Software Tools such as Volume Profile, Imbalance Tool, Market Profile, Footprint Order Flow, Delta & VWAP Charts.

Course Features

- Lectures 0

- Quizzes 0

- Duration 10 weeks

- Skill level All levels

- Language English

- Students 148

- Assessments Yes