🎁 Exclusive Discount Just for You!

Today only: Get 30% OFF this course. Use code MYDEAL30 at checkout. Don’t miss out!

We’ll teach you the Charting Best Practices used to select the right stocks according to our framework as well as the best likely entry point strategies to avoid as much future drama as possible.

Low Stress Training – Low Stress Options Trading

“This Framework Is Designed To Be

Easy For You To Follow”

See, here’s what many traders in this industry won’t tell you. They are inherently good traders, if not exceptional traders. And even though they can produce phenomenal results, it doesn’t mean they can teach you to do the same.

John and I have experienced this first hand. We’ve paid tens of thousands to Options gurus that, while great traders, were lousy teachers. Most of their teachings were chest-thumping ego trips showing how good they were at everything.

Look, it doesn’t matter how well we can trade this framework. What matters — the only thing that matters — is how easy is it for YOUR Business to get results! We’re all adults here and you know we cannot guarantee anyone will repeat our exact performance, of course.

We do not try to impress you with our knowledge of Options. In fact, we completely avoid that entirely. We don’t confuse you with tons of jargon, keeping it to a minimum. Of course, there is some learning required…

We focus on a 1% approach

The 1% focus is super important in this framework. It doesn’t just apply to goals though, it applies to our entire low ball mindset and philosophy. It is a mantra that carries through in everything that we practice and teach and one that is the key to YOUR success:

We only teach you the 1% you need to know.

We don’t overwhelm you with trading insanity. We focus on the bare minimum you need to know to help you produce consistent weekly resultsmany.

We only require 1% effort.

We know you’re busy. Hell, we’re busy too. John has another company, and I run five companies. This has to be a minimal effort program for us to do it, too. That’s why we’ve designed it to be a program that can potentially be run in just 1-2 hours of time per week.

We focus on 1% a week goals.

The target of the framework is for you to grow your portfolio by an average of potentially 1% a week. Some weeks may be more, some less. Some weeks you may have no capital to trade and make nothing. But our core goal is to set a low expectation that we can generally hit and keep that account size compounding week after week. Neither John nor I, nor many of our students trading this strategy, rarely have losing trades or, even rarer yet, a losing week. Since we are paid cash premiums the moment we sell the option, we are setting ourselves up the best way possible to potentially generate positive results over and over again, potentially every week.

In the Low Stress Options Program™, we teach you how to USE the stock market to potentially create cashflow, NOT by owning the stock (unless you want to, in which case we’ll show you how that can work too, it’s just not our preference), but rather… teaching you how to capitalize on market trends so you can ideally succeed, potentially each and every week.

It doesn’t always work out that way, of course. In the beginning, if you have a small account, you may not have any results in some weeks. It is also possible that you could lose money if a company you are trading goes out of business, or gets delisted from the NYSE/NASDAQ, or something equally odd. Trading is fickle that way, and there certainly are risks.

We’re not greedy, but we simply don’t believe that a 30-35% losing rate is acceptable — that is why we just loathe day trading.

If you’re going to be a day trader, well, you have to accept that. You have to get comfortable with losing 30-35% of the time. Day trading is all about winning a little more on your wins than you lose on your losses. Some day traders only win about 55% of the time. Sadly, most day traders blow up their accounts because of the insane amount of mental discipline that it takes to be successful, not to mention a massive amount of experience and experimentation.

We avoid nearly all of that stress and drama.

“Profit and Simplicity”

Look, there are lots of different types of Options trading strategies out there, tons of them in fact. They also all seem to have these odd sexual innuendo-based names that make me chuckle (not sure what that says about traders… haha):

Here are a few you might have heard of:

Naked Puts (Ooh… “sexy”)

Covered Calls (Keeping it PG-13)

Married Puts (Oh, NOW we’re getting serious)

Bull Call/Put Spreads (No, not going there…)

Bear Call/Put Spreads (Or here…)

Protective Collar (Is that like a Chasity Belt?)

Long Straddle (Oh… don’t get me started!)

Long Strangle (Do you strangle AFTER you straddle? What’s the proper etiquette here? I’m so confused…)

Butterfly Spreads (Not definitely not gonna go here…)

Iron Butterfly (Ouch! Sounds painful)

Poor Man’s Covered Calls (Wait… Is this the “off strip” Vegas experience?)

And on and on and on…

But in Low Stress Options™, well… it’s in the name!

“LOW STRESS!”

We’re not trying to make you experts in every aspect of Options trading. Nor are we going to teach you every single nuance of these many (MANY) strategies. Nope, not at all. We’re simply not qualified to teach most of those strategies even if we wanted to… and we don’t.

That definitely NOT the Low Stress approach.

We keep it SUPER simple.

We only use ONE primary strategy about 80% of the time and, sometimes, a second one, but that’s it!

Why?

Because money is boring if you are doing it right. As a former nuke engineer, trust me, we like boring… we don’t welcome surprises when overseeing a nuclear reactor cruising along at X knots and Y feet under the Atlantic in a submarine (sorry, X and Y are classified).

And the Low Stress Options™ program is all about potentially making a boring 1% or so a week on your portfolio, AND doing it IN THE LEAST AMOUNT OF TIME POSSIBLE!

This last point is super important.

We’re not looking to spend all day looking at the computer and chasing the market. With this strategy, you can realistically spend just an hour or two a week, and potentially crank out 1% or more a week pretty darned easily.

Options can be rather complex, but don’t worry, we’re not going to go there! We are not trying to impress you with how much we know about options. We simply focus on the 1% of knowledge you need to know and nothing more.

And ya know what? Even if you hate the concept of trading, this is the perfect program for you. Think of it the way I explained it to my 26 year-old son the other day.

He just rented an apartment. He’s not a trader and really isn’t inspired to become one. So, I asked him if he liked taking out the garbage in his apartment, vacuuming, and washing the dishes.

“Hell no!” was his appropriate response. I mean, seriously, who likes that stuff?

But that couple of hours a week you spend cleaning the apartment is what allows you to enjoy the rest of your time in it. If you didn’t do that, you’d likely land yourself on an episode of Hoarders! No one likes cleaning, but you do it to enjoy your house or apartment.

So I encouraged him to think of trading the same way, and he got it. He could just spend a couple of hours a week taking care of his money and, in turn, it would begin to take care of him.

Which brings me to my next point…

Low Stress & Low Yield… Or Is It?

You may be asking yourself, “C’mon Troy & John… ok, the Low Stress and low time commitment part I get… love that… but low yield?”

Well, let me explain. Yes, it’s only about 1% a week or thereabouts. Actually, I’m being purposely conservative on that number because I really want to under sell it and not overhype it to you.

Now, again, you may be saying to yourself, “But, geez… 2.30%? You make 20% and 30% on {Crypto|Forex|etc.} trades all the time. Why get excited about 1.0% or even 2.30%?”

Here are MANY reasons why:

#1 — This approach generally wins at a very high rate. Yep, it almost never loses (I haven’t lost money on any Options trade using this strategy yet in several months, except for than one previously mentioned intentional loss… but there are some “odd” scenarios that can occur every now and then, and I’m certain more may potentially cause me to take some small loss esat some point in the future. But don’t worry, we talk about that too).

#2 — 1% a week is really 68% a year! Yeah, depending upon how you do your math, and whether you consider 365 days or 252 trading days, compounding or not, etc… But let’s not get greedy, let’s go with the lower number and say it’s just 68%. That is a 68% potential growth rate in ONE YEAR! That is an insanely high return, and when you couple that with the 98%+ win rate, you may get that return because you won’t have losses offsetting it.

Of course, all of this assumes you were to consistently get 1% every week. Naturally, this is theoretical and not any type of guarantee. It’s simply the metric we shoot for in our framework. You can see from my weekly results posted above that it varies.

With potentially 68% per year compounding interest, you could possibly go from a $10k account to as much as a $47k account in 3 years… and to $132k in 5 years… and to a whopping $227k in 6 years! Again, all of this is theoretical with lots of assumptions.

Now, let’s do some more math. Even assuming these low potential 1% numbers, you could then potentially take 1% of, say, $200k out each week as your “draw.” That could potentially generate as much as an $8k monthly income stream.

All this assumes only a 1% a week gain AND assumes you never put any more money into the account.

Now, you won’t be able to sustain the 2.30% a week average I’m seeing as your account grows, in fact, mine is trending lower now as well. As the account grows, the percentages tend to go a bit lower. So don’t look at this as some sort of “this will happen” scenario or claim, but just a theoretical exercise showing you the potential.

And by the way, when you start approaching $500k and up in your account, it can become a little more of a challenge to keep those same percentages. However, at that level of account size, it doesn’t really matter, either…

#3 — You can do it with near ZERO fees. Yep, we’re going to show you two different accounts (and yes, I have them both), with two different brokerages. One of them has nearly zero fees. Near zero fees means your money grows faster (fees are just 0.03 per contract).

#4 — You can do it without any margin requirements in most countries or usually worrying about “pattern day trader” issues. Because we never buy and sell the same day, there’s no need for the $25k account type required for margin and day trading laws. And we don’t require margin either. In fact, I just went through a ton of work to take margin OFF of my account — it is simply not needed and just adds risk and complexity. You can use it if you want, but we neither require or teach it in this program.

#5 — You almost never actually own the stock (unless you want to). We only sell insurance… or Options… on the stock. That means, in most cases, we generally don’t even take possession of the stock. Even when they try to assign it to us, we cleverly avoid it most of the time AND get paid even more in the process! If you want to take possession of the stock, you can. We just choose not to most of the time, and make more money in the process.

Occasionally, you won’t have a choice, and will be assigned stock shares, but our framework helps shift the odds in your favor. And even if you are assigned, we teach you how to deal with that, in a potentially profitable manner, too.

#6 — You can trade the U.S. market internationally too. Even if you’re not a U.S. citizen, and/or live in a different country, you’ll likely be able to open an account with the U.S. brokerages unless you’re on their banned list. If that’s the case, then all we can do is provide you with some GPS coordinates to a better place to live, or use an international brokerage of your choice and trade the U.S. market. We do have a preferred international brokerage that many of our international students use that we can direct you to.

#7 — You can do it in about 1-2 hours a week, very realistically. Sure, when you’re first getting started it may take a bit more time, but once you master the framework 1-2 hours a week is easy to achieve.

The way your account can grow is mind boggling if you can consistently add a little money to the account on a weekly basis to further the growth.

See below:

Hell, I’m even considering selling off the other two vehicles that I own free and clear, buying a used low-cost vehicle instead, and throwing another $125k into the account! Had I known of this approach 20 years ago, I might have potentially retired in my early 30’s! And it’s been around that long for sure… much longer.

What is your goal?

If your goal is to learn all of the theoretical science behind the Options greeks or how to do a “double-blind death strangle with a twist” (ok, I just made that one up… but I have done 100’s of Iron Condors)… then, yeah, I’m not your guy and neither is John.

But if you want to learn what we believe is the simplest way to trade options:

for pretty consistent results

with fairly low risk of loss

with a very high win rate to consistently grow your portfolio

that likely takes just a couple hours of work a week

…then we’re exactly who you’re looking for.

The fact that we don’t do all of that “fancy stuff” is not a limitation. In fact, it’s a benefit to you because we will not waste your time with the risky stuff, or bulk up the strategy with unnecessary information. That’s what you’re getting when you learn from us.

Just to be clear, it is not that we don’t know how to do spreads and other complex option trades. We just ditch their complexity and risk for a simpler way… a “Low Stress” way.

Look, I’ve made 520% on an option trade in 4 days. I’ve day traded options and made over $6k in a day. But I’ve also lost thousands with these more complex strategies, as well. It takes soooo much time and experience to master them, and even when you do, they still only have about a 60 to 70% win rate. That’s not bad, but it still means you’ll be taking a lot of losses.

At this point in our lives, both John and I are much more content with smaller results that are fairly consistent, require much less management time and a very low loss rate. If that resonates with you, then this is the program for you. On the other hand, if your goal is just to learn everything you can about trading Options, in all of its nuance and complexity, we’re definitely NOT the right guys for you.

Our promise to you is to not go deep into the woods of Options… but to just keep you on the outskirts, learning what you need and nothing more.

This perceived weakness is actually our strength. The weakness of not having 20 years of Options trading is what makes us exactly who you want to work with.

If you hire someone else to learn all of the complexities of Options, I can assure you that you will pay 5x-10x (or more) for the privilege of being confused as hell for about 2 years or more, AND will likely lose a lot of money in trading mistakes with those crazy complex spreads and other tactics! The amount of crazy complexities and subtleties of Options trading is mind-blowing and exhausting. We simply avoid 99% of that and focus on what can work better.

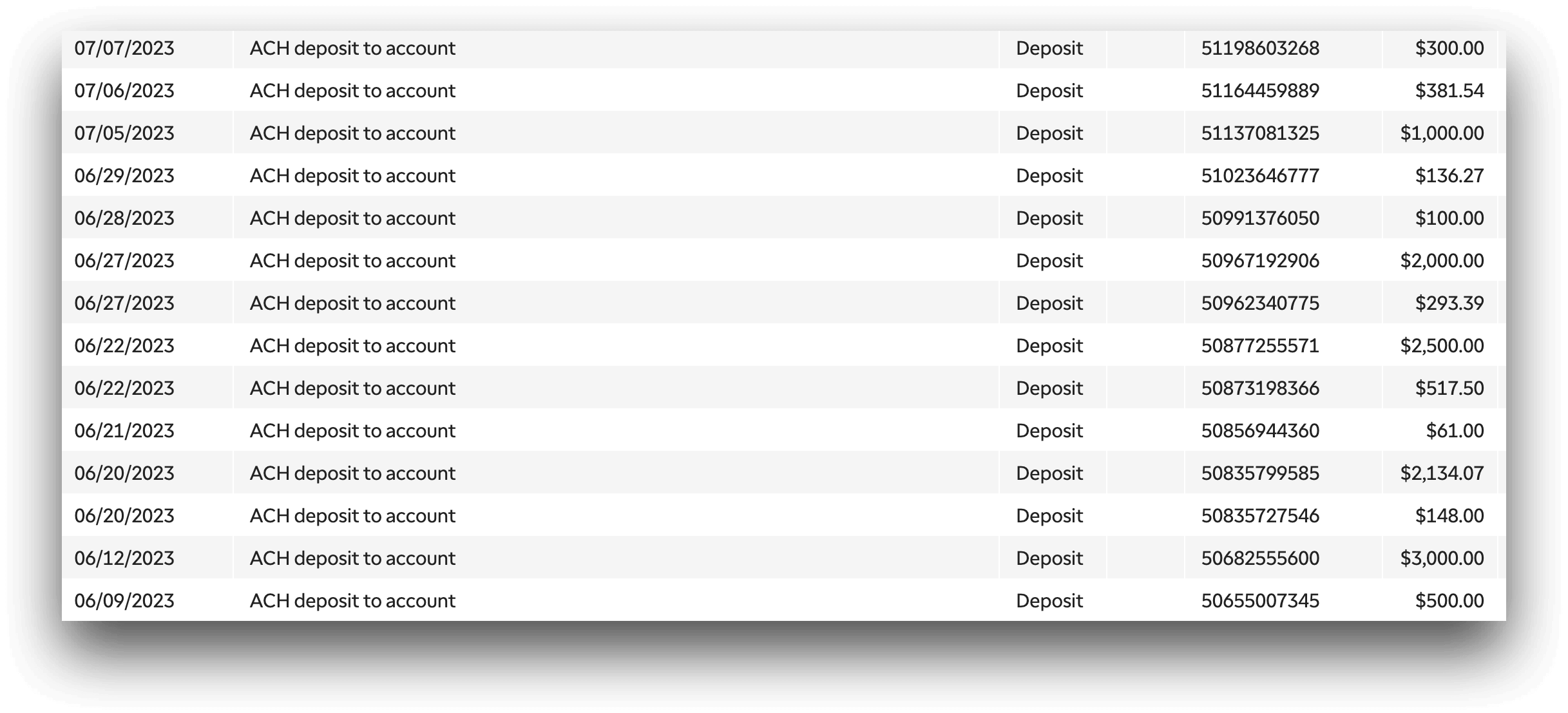

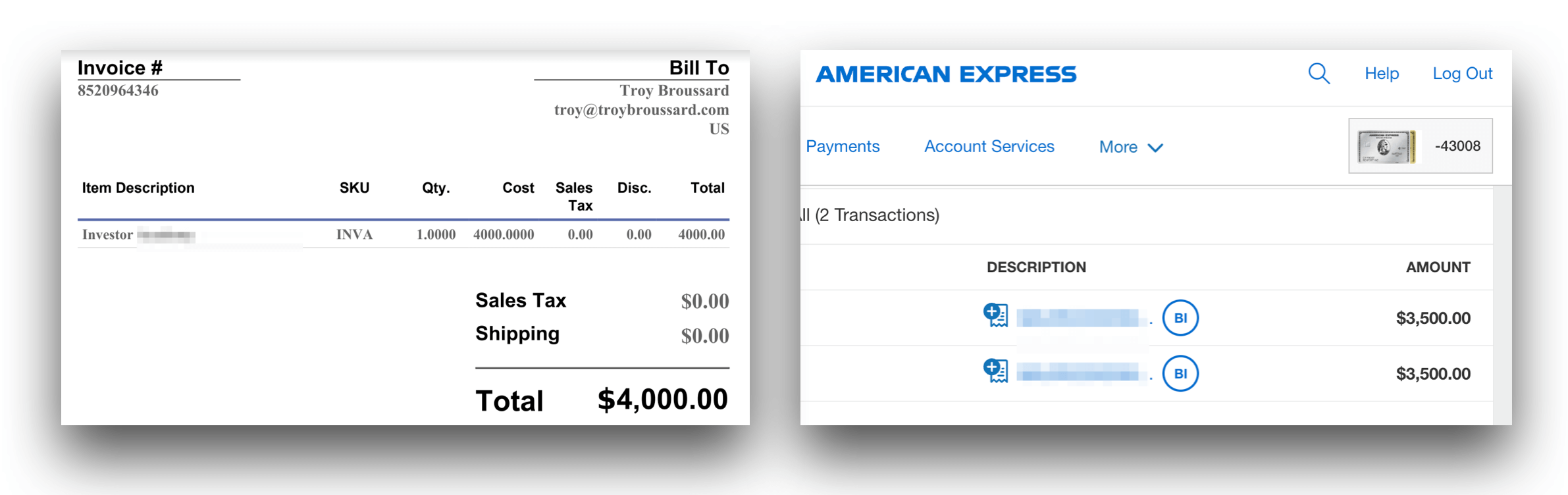

In full disclosure, I paid $11,000 for my Day Trading & Swing Trading Options training, and it only focused on one strategy. In full and blatant transparency, here are the receipts from that $11,000 investment. I want you to KNOW that I know the value of training and take this very seriously.

We simply have no desire for any of the complexity that most teach.

This Low Stress Options™ model is all about low and slow, super-simple, 1% a week potential gains with as little time as possible invested. Boring and predictable. Simple to manage. Nothing to keep studying, researching and learning.

And not taught by guys full of themselves trying to impress you with all they know. (That guy I bought the $11k training with is the most arrogant a**hole I’ve ever met).

Instead, it’s being taught by two guys that value their time more than anything else, practice what they preach, and are teaching how to leverage more and more of that precious time with Options.

Boring, simple, consistent, low stress… That’s what we’re focusing on here. Unexciting little consistent results, potentially week in and week out.

Who Is This For?

If you have a desire to work less and just “use” trading as a way of providing that escape…

If you don’t love trading, but just want consistent results for your business that have the potential to far outpace the bank or other investment mechanisms…

If you prioritize your time, and the freedom it brings, over money (but money is still important)

If you’re uncertain of our economy and future in this country (world?), and want to just have some more peace of mind…

If you’re not really looking to learn more or devote yourself to becoming a trader, but just want a brain dead simple and consistent strategy you can execute on…

If you’re totally fine making potentially 1% a week, sometimes a little more… sometimes a little less… and willing to be patient and let it grow…

If you aren’t compulsively fiddling with everything all of the time and can actually enjoy the simplicity…

If you have at least $4000 or $5000 to invest into your brokerage account and a couple hours of time a week during open market hours…

If you can be happy and content with a potential “paltry” 1% a week growth rate… (which could yield as much as 68% or more annually)

Well… then this is the program for you.

What You WON’T Get…

Pompous instructors with decades of “attitude,” pedigree and more knowledge than patience or teaching ability

A focus on impressing you with our knowledge of Options and constant teaching of new techniques, sending you down the rabbit hole of forever feeling like you have to learn MORE…

Any requirements to buy any other software. Down the road, you may want to invest in an options screener we use, but that’s it, and it is certainly not required when you’re just getting started. There are no indicators you have to buy. No charting software you have to invest in. Nope. Everything you need is either free or included in your brokerage account.

An “alert only” service that only sends you trade alerts but never teaches you how to research your own picks. We believe in not just giving you the fish, but teaching you to fish as well! While we don’t give trades or provide trading advice, we do give notifications of the trades we take and how we apply our framework as educational examples to learn from.

What You WILL Get…

We’ll cover brokerage selection, account setup & helping you get authorized for Options trading

We’ll teach you the simple trading approach we use and nothing more — this is all about keeping it simple

Training on how to select the right stocks to trade Options on so you can pick your own

We’ll cover how to implement this particular type of Option strategy on both platforms we support

We’ll teach you the Charting Best Practices used to select the right stocks according to our framework as well as the best likely entry point strategies to avoid as much future drama as possible

We’ll also teach you Troy’s Charting Best Practices to document and manage your trades visually if you like

Weekly live coaching with John and Troy dedicated to Options. On the call we will do live Options trading, and you can place your trades at the same time, if you want. We’ll do the call during live trading hours, but if you can’t make it because of work and such, it’s not a problem. You’ll get the recording and can enter your trades later. After all, you’re only trying to get a 1% potential yield, so if you miss the early morning entry you can get them the next day. It’s really not that big of a deal.

Every trade we take will be posted in a separate Telegram channel dedicated to Low Stress Options™ for you to follow along. We’ll give you the ticker, strike price, and all of the details. These are not trade alerts nor advice, but notifications of what we’re doing and how to apply our framework for teaching and educational purposes.

A very consistent schedule. We’ll tell you when to place orders, and when not to. We’ll give you the absolute framework for when to push out the expiration date of our positions (don’t worry, we’ll explain it) and what time of day to double-check your open trades.

We’ll go into detail about the “assignment” process and why we prefer to avoid it, but how, even if it happens, it’s not a big deal and can potentially be very profitable.

We’ll teach you the strategy of how to get your fees reduced if you’re on our fee-based platform recommendation.

We’ll cover how to leverage Covered Calls if you prefer to take assignment and hold the stock. And yes, we’ll explain the pros and cons of it all and why you may or may not want to as well.

You’ll get access to the Low Stress Options™ community — an active, thriving group of fellow traders who share successes, answer questions (sometimes faster than we do) and encourage each other.

You’ll get access to the training for a minimum of six months, or for as long as you stay subscribed.

And, of course… a whole lotta us… “priceless”… haha… on weekly live training calls showing you exactly what we’re doing and the Options we’re selling!

Course Features

- Lectures 0

- Quizzes 0

- Duration 10 weeks

- Skill level All levels

- Language English

- Students 75

- Assessments Yes