🎁 Exclusive Discount Just for You!

Today only: Get 30% OFF this course. Use code MYDEAL30 at checkout. Don’t miss out!

How to observe swings in the market… how to create plans that include identifying support and resistance levels… and how to use charts for visualizing trends and key levels… you’ll no longer have to blindly guess market direction. In this training, you’ll learn these crucial skills.

File Size: 6.7 GB.

Riley Coleman Trading – 90 Day Confident Trader Program

2. How To Consistently Find Reversals

My Reversal Strategy Overview

It’s important to understand the goal of the strategy so you can approach it the right way. Knowing the goal and how to approach the strategy is crucial to properly executing it consistently everyday.

Keys to Identifying Reversal Setups

Understanding retest reversals and failed breakout reversals can help you identify potential trend shifts early, and help you avoid getting caught in prolonged choppy movements that don’t lead to significant market shifts.

Recognizing excessive chop can prevent you from entering losing trades prematurely due to market indecision but more importantly you can capitalize on market reversals for profit.

Entry Checklist Deep Dive

5 detailed videos talking about each point in my entry checklist. This is important because every part of the checklist serves a purpose to find the best trades possible so understanding each component is crucial. Without this you won’t be able to fully understand what makes it work.

Using Risk Reward to Your Advantage

How to use risk reward to set yourself up for success in this section I will show how I use risk reward for entering into my trades but also for analyzing if a trade is worth it or not to begin with. This is an often overlooked but crucial part of every trade.

Advanced Market Movement And Patterns

With advanced chart reading, we’re now understanding market volatility… price movement… signals like climatic moves and failed breakouts… while we also focus on finding potential trade opportunities with favorable conditions conducive to profitable trades and better risk-reward ratios.

3. How To Consistently Execute & Manage Trades

How to Profitable Manage trades

Learn the process you want to follow for managing your trades. You don’t want to start out the wrong way because over the years I’ve slowly increased the complexity of how I do it. I’ve laid out a plan for you to follow as you get better and better at trading.

The News Release Navigator

Know what the market will do during each news release so you know if you need to avoid being in a trade or you can hold through it. This will drastically change how you can approach the market every day.

My 7AM Reversals Roadmap

I specifically go in depth on how the market best sets up reversals right after the open so you know how to spot these valuable opportunities but also when they aren’t there and wait for another day. These are very profitable if done properly.

Properly Entering Into Trades

When it comes to entering a trade there are a lot of little things that happen that are often overlooked or not explained in my youtube videos. I’m going to go through every possibility and what to do when it happens and what order types you should be using.

Months of Trade Examples

I’ll show you tons of real examples and highlight the importance of trade management (real-time execution, the checklist approach, & confirmation signals) … risk management (protecting profits, limiting losses, & setting relative targets to risk) … and consistency/discipline (sticking to a plan, following rules, & how to avoid emotional decision making) … and if you’ve ever wanted to know when to avoid entering into a trade even when the signal shows up, then you won’t want to miss this section!

4. How To Grow Your Trading Business

My Brokerage and Chart Setup

Not all brokerages are created equal. If you want the ability to trade actively on charts, place bracket orders, and have low margin requirements, then you’ll need a brokerage that gives you the freedom to trade how you choose. I’ll walk you through how I have everything setup so you can trade exactly how I do.

How to Properly Grow Your Account

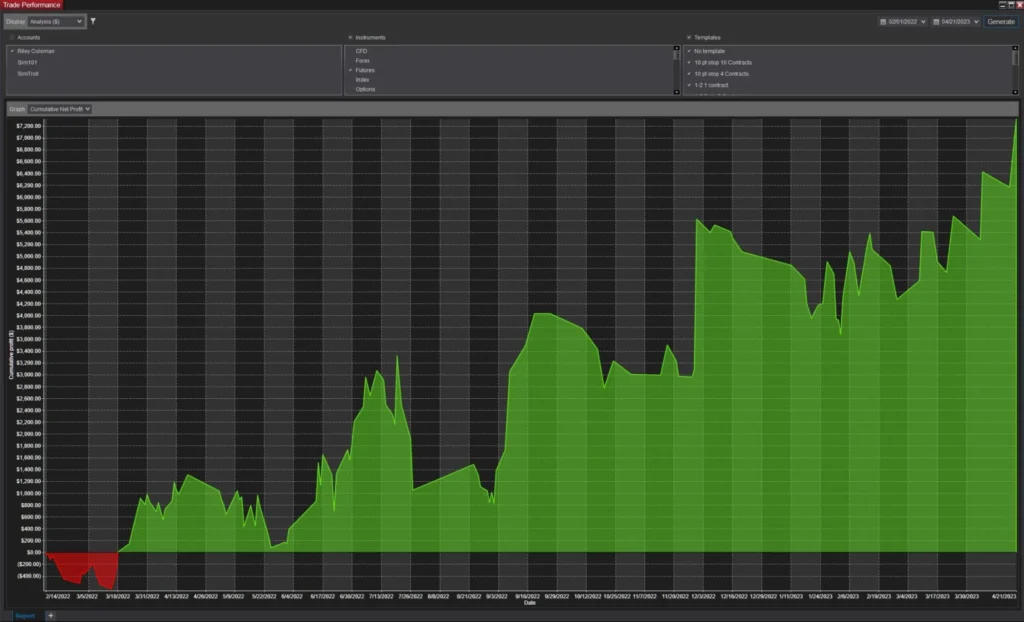

I started this journey with a small account and have grown it over time. I am going to give you the steps that I would follow if I had to do it over again so you know exactly what you should do to grow your account and not cause blow ups.

How To Consistently Improve Your Trading

Trading is a constant growth process. If you don’t journal your trades properly you won’t succeed as a trader. You’ll learn what to journal to succeed in the long run. This is the foundation of every successful trader. The only way to know how to get better at trading is to keep track of it.

My Trading Plan to Continuously Grow

I’m going to walk you through what my plan looks like, how you can adjust it to fit your trading style and needs but I’ll also show you a little secret that I’ve been using which will help you to slowly improve over time… without it, your trading will likely fail…

Advanced Management Strategies

I will go over even more advanced styles of managing trades that you can use down the road as you become profitable so not only will this course help you now, but it will help the future trader you are going to become. This 3 Step Sizing Growth Plan will drastically increase your chances of becoming profitable.

6. How To Control Your Emotions

Stimulus – Gap – Response Framework

Learn to create a deliberate pause between market stimuli and your response. This crucial skill enhances emotional regulation and decision-making in trading, leading to more thoughtful, strategic actions and minimizing impulsive reactions.

Stopping Your Impulsive Trades

Break thought patterns, increase self-awareness, and prevent reactive decisions. I’ll show you how to do this effectively so you can recognize and control your emotional triggers, leading to more grounded, focused, and successful trading.

This is extremely effective at improving your ability to execute the right trade.

Creating Your Emotional Spectrum

Understanding this spectrum enables you to identify emotions that enhance or hinder your trading decisions. Have you ever wished you could stay calm amidst the chaos that is unfolding and causing your mind to race out of control? …

Well, you’ll build your Emotional Spectrum so you can know when to get in a trade or when to stay out. This will help prevent you from making emotional decisions like chasing trades and revenge trading.

Accelerating Your Growth

Visualization, a technique often overlooked, is the secret weapon that transforms trading from a stressful gamble to a controlled, confident endeavor. You’ll learn how to accelerate your growth process through this process.

7. How To Become Consistently Profitable

The Best Trading Routine

Most traders fail to realize how a disciplined daily schedule dramatically improves decision-making and mental sharpness. Having a consistent routine helps you know when something is off, potentially affecting your trading.

But also you need to know how to set yourself up for daily success and what types of routines help with that. Don’t worry you don’t need to take a cold shower at 4am to do this!

Stopping Loss Streaks and Blow Ups

Resetting mental capital is more than just taking breaks; it’s about strategically rejuvenating your mental state to maintain peak trading performance. You’ll learn to prevent burnouts that cause massive loss streaks. You’ll learn to recognize and manage emotional drain, and decision fatigue. This is the key to being profitable over the long term.

Fine Tuning Your Trading

By focusing on fewer, higher quality trades, you avoid the common pitfall of overtrading that plagues many amateur traders. Feel the shift from chaotic trading to a streamlined approach, where each trade is a step towards consistent profitability. Think about it, just taking out 25% of your losing trades would drastically change your results.

Becoming In Tune With The Market

You’ll pull together all the frameworks we’ve built over the last 9 weeks to see how they truly work together. By this point, you will be well on your journey to understanding when you are at your peak trading performance and when you just shouldn’t trade. Combining this with your trading knowledge we’ve built, successful trading will become like muscle memory to you.

Course Features

- Lectures 0

- Quizzes 0

- Duration 10 weeks

- Skill level All levels

- Language English

- Students 78

- Assessments Yes