🎁 Exclusive Discount Just for You!

Today only: Get 30% OFF this course. Use code MYDEAL30 at checkout. Don’t miss out!

Whether you have been trading for only a few months or have a decade of discretionary experience under your belt, this bootcamp is suitable for for traders at any point in their journey.

File Size: 1 GB

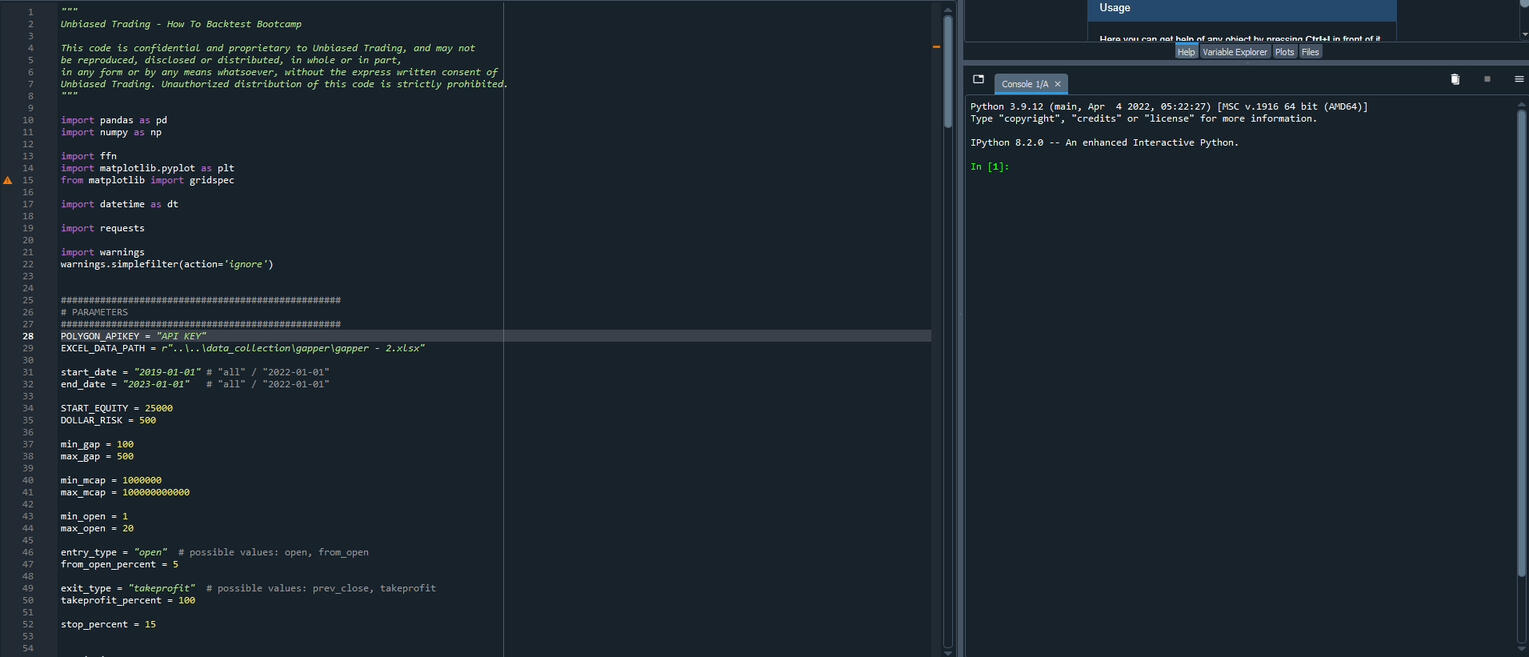

Unbiased Trading – How To Backtest Bootcamp

Unlock Bullet-Proof Edge In Your Trading In 30 Days.

How To Backtest Bootcamp has accelerated over 59+ traders’ journeys getting started with Backtesting and trusting numbers instead of intuition.

Unlike other trading courses, it’s not just theory – you have access to 15+ Python template codes to pull data with no coding experience needed, master the A to Z of strategy testing and transform your trading perspective through data-driven insights.

Whether you have been trading for only a few months or have a decade of discretionary experience under your belt, this bootcamp is suitable for for traders at any point in their journey.

Why You Should Backtest

Evaluate

Backtesting allows you to evaluate the effectiveness of your trading strategy / idea over time by using historical data and testing your strategy against it.Without this you are trading strategies without the confidence of statistical / historical proof of working.

Become Objective

Backtesting makes you become more objective in your trading. When you rely solely on visual intuition or “gut feelings,” it’s easy to fall into the trap of confirmation bias or other cognitive biases.Backtesting removes emotion & impulse from the equation as you rely on data-driven edge instead to guide your trading decisions.

Optimize

Backtesting lets you optimize and practically identify areas for improvement in your trading strategies / ideas.Without this, it can be very challenging to see the weaknesses of a strategy until your personal account equity faces it.

Is The Bootcamp Right For You ?

- Stuck Manually Tracking?

You spend hours after close inputting different data points while gradually falling asleep & accidentally typing another 0.But you know there must be a more efficient method of doing this.

- Tons Of Data But No Idea How To Apply It To Your Trading?

Thousands of columns of different tickers & trades but every time you try and analyze, you’re more confused on how it can be used in your daily trading.You know data is important, but lack the knowledge to use it effectively.

- Are You Suffering From Low Conviction In Your Strategy’s Edge?

Every time you see a trade, you hesitate to take it. When it works you know you should’ve taken it, when it doesn’t you thank yourself for not taking it.However, you know this isn’t how you should be trading your edge.

- Stuck Writing Code To Extract Data?

Ever found yourself stuck watching countless tutorials on how to pull data from various providers or use backtesting libraries?You know its possible, & with your limited or lack of Python knowledge, you’ve come close, but haven’t got it to run.

The Blueprint

| Code Template Library 15+ pre-built backtesting code templates on day 1 divided into strategy & data collection (a $29 API will be needed). Eliminating the need for manual tracking & creating more time for edge discovery. |

| Guides Step-by-step video & document guides walkthrough how the code templates function (+ how to install everything), enabling you to modify or use them as is. Eliminating the confusion of using code for trading. |

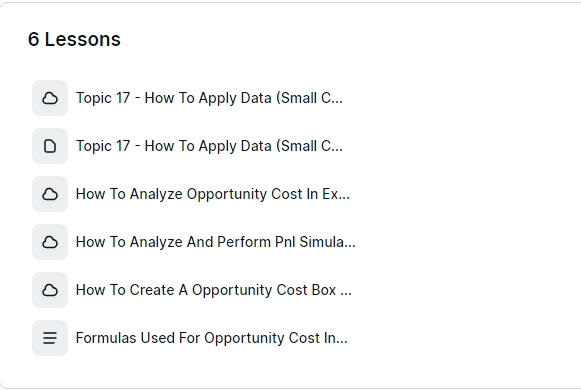

| Using Data In-depth content on how to analyze and apply data in various markets and frameworks. Showing you how to leverage data to improve your trading. |

| Video Library 15+ topic videos covering data, best practices, data analysis & thinking in code. From beginner to advanced video format content. |

| Data Visualization Understanding how to use visualization to spot new ideas and patterns in data. Erasing data overload. |

| Data Visualization Understanding how to use visualization to spot new ideas and patterns in data. Erasing data overload. |

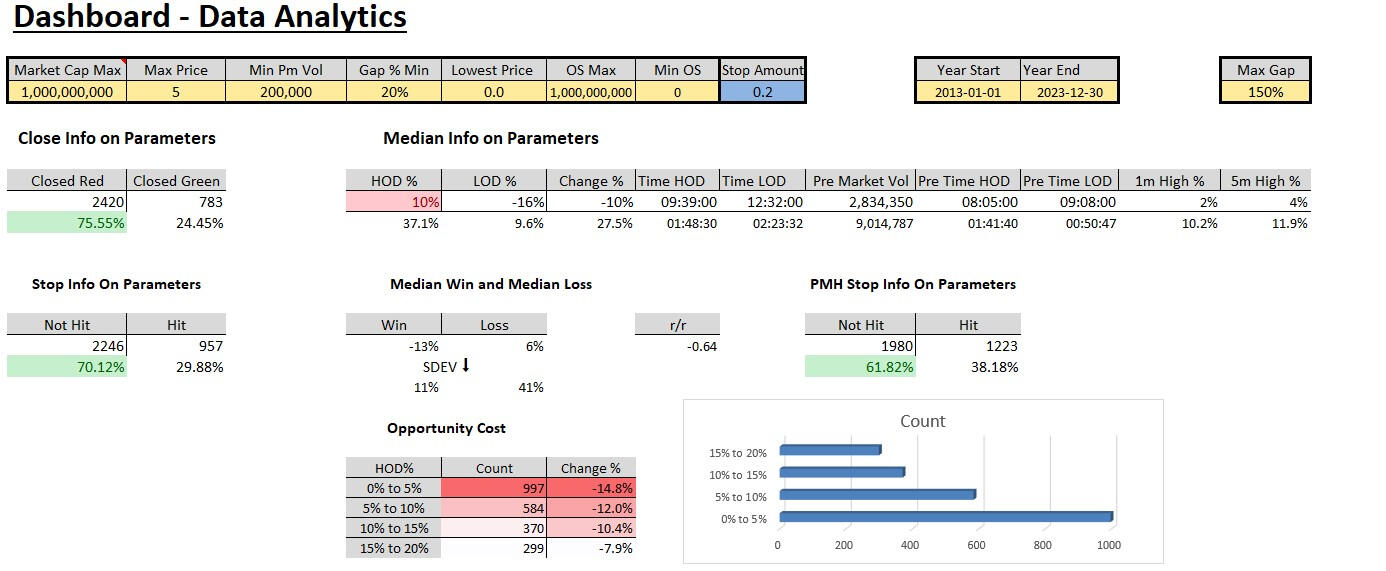

| Excel Guide Step-by-step guide on creating & customizing a personalized dashboard to help analyze large datasets just like mine. |

| 1-1 Calls 1-on-1 coaching calls to help you apply data to your trading. Giving contextual advice specific to you. |

| Bonus Algo Bonus Ninjatrader futures algo introduces you to how algos are built. Gain Valuable Insight into the Art of Building Successful Trading Algos. |

| Future Additions Alumni retain access to additional content added to the Bootcamp . You’ll also be able to suggest extra content you would like added to the Bootcamp For Free. |

| Reflective Checkpoints You’ll be able to assess your level of progress and note down your overall experience to track your advancement. |

What’s Inside The Bootcamp

* All content is recorded or written, there are NO LIVE SESSIONS. This structure is fit around

the 1-1 bootcamp calls and is simply to help you structure your progress of learning (which is ultimately up to you).

15+ Python template codes to pull and backtest data on various common strategies for large caps and small caps with no coding experience needed.Code Templates Included: Pull historical charts – Pull day 2 – Pull earning data – Pull first red day – Pull Multiday (2 versions) – Pull Parabolic – Backtest Day 1 + Day 2 gappers – COT dashboard – Backtest Large cap long strategy – Backtest Parabolic tickers – Backtest Small cap long strategy and many more.

The A-to-Z process of how to backtest, from what is a backtest and how to do simple things like manual tracking to more complex parts like Monte Carlo simulations, parameter sensitivity testing, and applying data and weighing different parameters.

How to apply data into different markets with a primary focus on small caps, plus how applying data in small caps and large caps differ.You’ll also be introduced how to add data into your trading from being fully discretionary to 50% systematic to fully systematic.

How to use Excel to analyze big data sets using custom formulas to create an intuitive and fast dashboard so you can find statistics that can actually help your real-time trading.

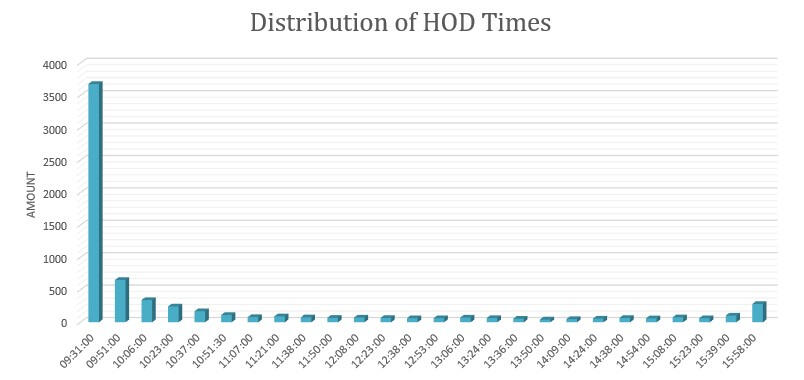

How to visualize data yourself to spot new ideas and patterns in data you gather using the pre-made code templates. To better understand potential correlations between variables and key statistics.

1-on-1 calls with me to give you direct assistance on any particular questions you have during the bootcamp, whether this be about your own trading strategies or just about backtesting in general.A 24/7 chat to ask any small questions, whether that’s just a simple question about a topic you’re consuming at the moment or if it’s a larger question that can then be taken into a one-on-one call.

Value comparison

Backtest Bootcamp

- $5,000 worth of pre-built code templates

- Clear step by step video & document guides for all code templates

- Understand how you can use data to directly improve your trading setups

- Personal 1-1 guidance with direct chat & calls

- In-depth content on leveraging data in not just small caps but large caps & futures

Alternatives

- Only provide a data download for $3,000

- No personalization available

- No guidance for backtesting & data application

- No resources for data analysis

Are you ready to improve your trading using data? Sick of wasting your hard-earned money and time on ineffective strategies?

Who’s Your Guide?

A little about me; I run my business specializing in helping traders develop backtesting, custom data collection code, & algo trading strategies. I pride myself on my dedication to my clients & wider community. I cater to various markets such as large-cap stocks, small-cap stocks, & futures, with the goal of providing traders the tools they need to make informed decisions & optimize their trading strategies.

My areas of expertise:

- Backtesting Solutions

- Custom Data Collection Code

- Algorithmic Trading Solutions

Track Record:

- Over 105 Successful Projects: With 105+ completed projects for my clients, I’ve been able to discover all the difficulties & nuances traders face when backtesting.

- 10 Client Algorithms: This has allowed me to see time & time again, the process of taking an idea from a backtest to deploying a strategy live.

- 6 In-house Algorithms: Beyond my work with clients, I also run 6 of my own proprietary trading algorithms, which have taught me so much of what I share in the Bootcamp.

Markets:

- Large-Cap Stocks: I’ve been exposed to trading large cap strategies like using earning data, earnings gap, ticker-specific strategies, etc.

- Small-Cap Stocks: This is my bread & butter, what I spent my first 2 years purely dedicated to & have employed data the most in this market.

- Futures: My experiences in futures have been an exponential journey from messing around on evaluation accounts to taking a strategy live 8 months later and horribly failing. But I have worked through it & and I’m grateful to have 2 profitable algos running currently.

Want to learn more about me: Check out the episode below

Course Features

- Lectures 0

- Quizzes 0

- Duration 10 weeks

- Skill level All levels

- Language English

- Students 129

- Assessments Yes